The Efficient Market Hypothesis(EMH) is an economic theory that states that an asset’s price reflects all of the available information. This means that it’s more or less impossible to achieve abnormal returns (unless you have extreme intelligence, insider information or excess capital). The academic community swears by this hypothesis but in recent times, it’s not been holding up at all.

Here’s an example. If you were watching the financial markets around January of this year, you know about the Gamestop saga. If you don’t, basically their stock went up more than 3000% in the span of a month. This is insane. Even more so considering the fact that they were on the verge of bankruptcy at the time. Gamestop was also one of the most heavily shorted companies (which is actually the reason this happened; something called a short-squeeze) but that’s not what I’m writing about today.

I only mentioned Gamestop ($GME) because it was the most prominent example, and at the time of me writing this article its still trading at over $200. But there are many more examples of stocks trading for way above their true value(meme stocks), all of them defying EMH. Let’s look at why.

How Does This Relate to EMH?

So the first and biggest misconceptions about EMH is that all markets are efficient and to the same degree. This is simply not true. For example, in the bond market, if two bonds have the same characteristics but one has higher yield, there’s no way they will be priced the same. This is because all of the information about the security is public, making it a good example of when a market is fully efficient.

This would not be the same for a stock however; there are millions of variables and discrepancies affecting investor decisions, and ultimately the stock price. A major characteristic of markets that aren’t fully efficient is the role of information in decision-making. Not everyone gets their news from the same unbiased place. For example, somebody might rely on the Wall Street Journal while another might rely on Mad Money’s Jim Cramer for stock picks, one obviously more biased than the other. An even more extreme example of this is the insane amount of people making a trade because reddit user DoubleDownDebbie said go all in on $PLTR stock on r/wallstbets, just because she’s got a “hunch” and “smells tendies”.

This just proves that ultimately, investments are made by humans (for the most part) and humans are not supercomputers, nor are we capable of processing all the information that exists. Even the miniscule amount we do accurately process is not guaranteed to be unbiased. The EMH functions as if that is the case; perfect humans making perfectly educated financial decisions, which for the most part won’t be true for a long time.

In the aforementioned case of $GME, the majority of people who invested in it probably didn’t do much research into the technicals of the company. If they did, EMH says that they would not have touched the stock. To be fair, $GME specifically had socio-economic motivations like taking money away from Wall Street, but it’s still the epitome of market inefficiency.

The Bottom Line

Personally, I think the market is as efficient as it can be, with the exception of people essentially gambling and misunderstanding the available information, cause pricing inefficiencies. Still, market inefficiency is something you can profit off of. You just have to do classic technical analysis and price securities as accurately as you can. This is the tried and tested method for investing over longer periods of time.

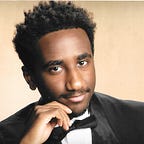

With every opportunity to make money lies risk, and remember there are downsides to this as well, so always keep this quote by one of the fathers of economics (pictured below) in your mind when investing: